A Smarter Way to Save: Strengthen Your Portfolio with Dynamic DCA

A Smarter Way to Save: Strengthen Your Portfolio with Dynamic DCA

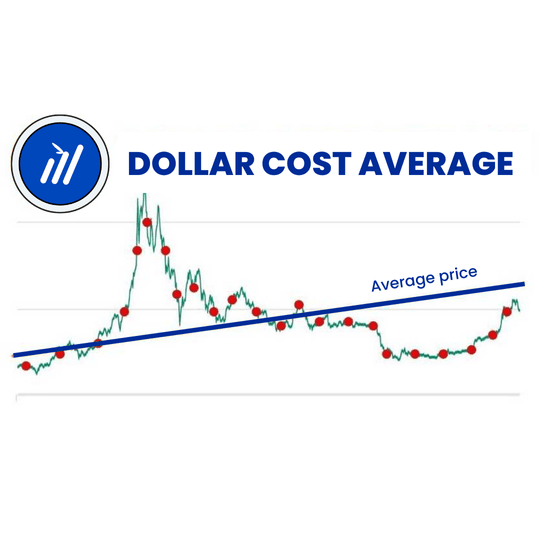

At Bamboo, we believe the best investment strategies aren’t complicated — they’re consistent. One of the most effective tools we recommend is ‘Dollar Cost Averaging (DCA): investing a fixed amount regularly’. It’s simple, steady, and helps remove the emotional rollercoaster from investing.

But once you’ve got the basics, you can take your strategy further —. It’s called Dynamic DCA, and it can be a powerful tool, to turn market lows into long-term opportunities.

Let me explain.

First: What is Dollar Cost Averaging?

Dollar Cost Averaging is the practice of investing a fixed amount of money at regular intervals — regardless of whether the market is up or down.

For example, you might set a $50 weekly top-up through Bamboo. Whether Bitcoin is soaring or dipping, your investment remains the same. Over time, this helps you build a position while smoothing out short-term fluctuations.

It’s ideal for those just starting out. You don’t need to predict the market. You just need to stick to the strategy.

So What Is Dynamic DCA?

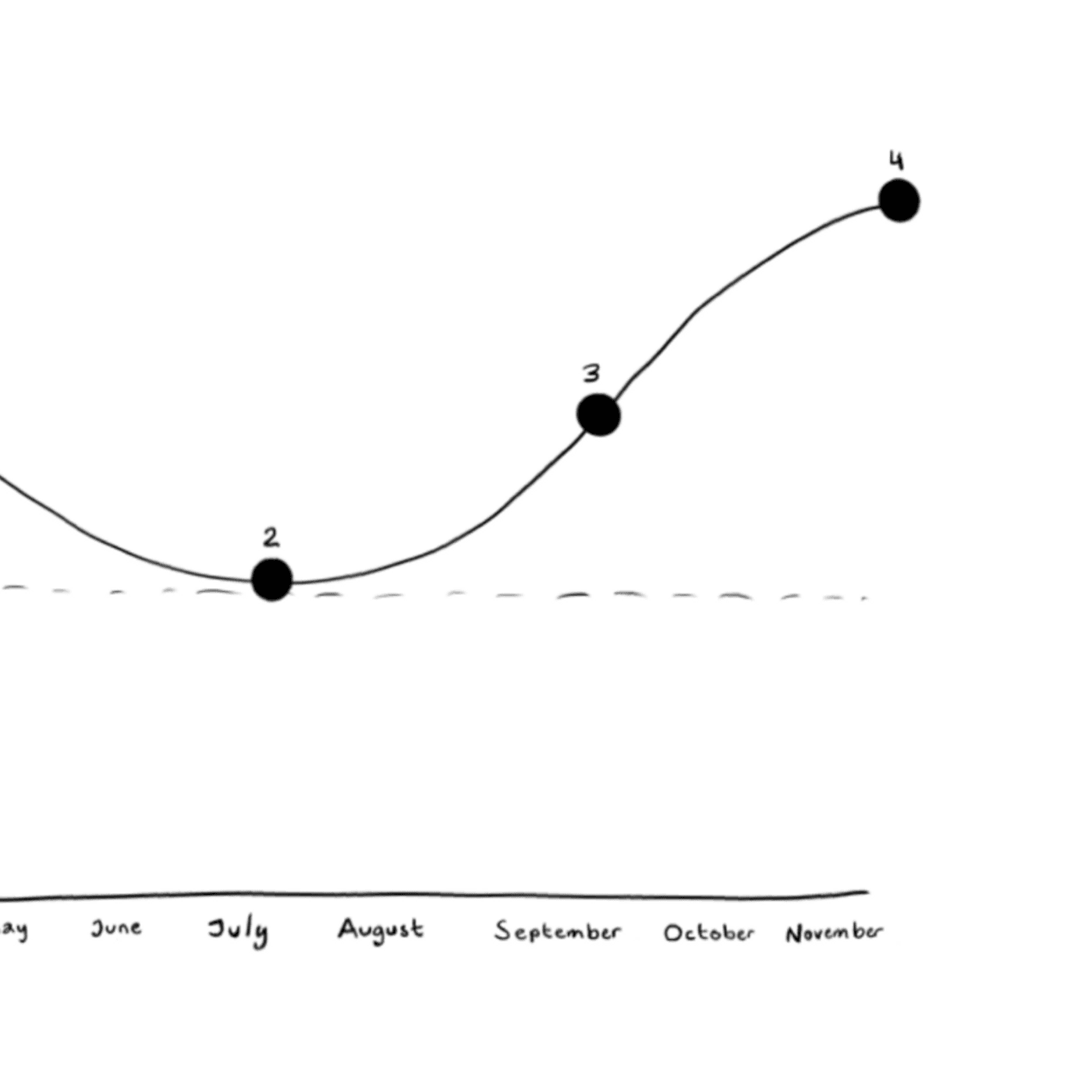

Dynamic DCA builds on the same principle — but adds a layer of flexibility.

Rather than investing the same amount each week, you adjust your recurring top-ups when the market experiences a downturn. The idea is simple: when prices are lower, you’re able to accumulate more value for the same amount of money — or slightly more if you're willing to increase your investment intervals or commitments.

Let’s break it down:

-

Static DCA: You top up $50 every week, no matter what.

-

Dynamic DCA: You top up $50 weekly — but when the market drops, you might increase that to $100 for a few weeks to take advantage of the lower prices.

The goal isn’t to time the market perfectly — it’s to be opportunistic when conditions are favourable.

Why This Matters

Markets move in cycles. Over the last decade, we've seen plenty of dips and plenty of market tops. Those who take a long-term view, and who invest steadily through both the highs and the lows, have statistically done well.

Dynamic DCA is about leaning into the discipline of regular investing, while giving yourself permission to be a little more strategic when the market offers a rare discount.

It’s the same mindset you might have in everyday life: if your favourite product goes on sale, — you might even grab a little extra. Dynamic DCA applies that same logic to your crypto savings.

How to Apply This in Bamboo

-

Start with a recurring top-up that suits your current budget.

-

When the market provides a discount, consider increasing your top-up for a short period — even a small boost can make a difference over time.

-

Once the market begins to recover, return to your regular rhythm — or maintain the new level if it feels sustainable.

All of this can be done easily within the Bamboo app. And as always, we’re here to help if you have questions.

Final Thoughts

You don’t need to be a professional investor to make smart decisions. What you do need is a consistent plan and the willingness to stay engaged, especially when others are sitting on the sidelines.

Dynamic DCA is one of the easiest, most effective ways to make your money work harder when the market is quiet.

Blake Cassidy Chief Executive Officer

Active vs Passive Investing: What's the Difference

Why Craig continues to buy regardless of the market

Dollar-Cost Averaging 101

The latest crypto news delivered straight to your inbox.

Subscribe to our newsletter