The Fear and Greed Index in Crypto: Explained with a Wink

The Fear and Greed Index in Crypto: Explained with a Wink

Alright, strap in! If you're new here - good timing, we’re about to dive into the wild and wacky world of the Fear and Greed Index. Think of it as a mood ring for the crypto market. Let’s break it down.

WTF is the Fear and Greed Index?

What It Measures:

Fear: Picture investors huddled in a corner, clutching their digital wallets and muttering, “Sell, sell, sell!” Prices drop faster than a hot potato 🥔🔥!

Greed: Now imagine investors gleefully swimming in a pool of digital coins, shouting, “Buy, buy, buy!” Prices soar like a rocket 🚀

Ingredients in This Crypto Burger:

- Volatility: Measures how much the prices are dancing around. High volatility? Investors are likely biting their nails.

- Market Momentum/Volume: Looks at the trading action. Lots of trading? Investors are either partying or panic-selling.

- Social Media: Checks out what X is buzzing about. Lots of crypto chatter? Could mean investors are either jumping for joy or crying into their keyboards.

- Surveys: Asks investors how they’re feeling. It’s like crypto therapy.

- Dominance: Looks at how much Bitcoin is hogging the spotlight. High dominance means everyone’s clutching their Bitcoins like an influencer 💅 clutching their phone!

- Trends: Analyses what people are Googling. High search interest can mean investors are either frantically Googling “how to survive crypto crash” or “how to buy a Lambo🏎️ with Bitcoin.”

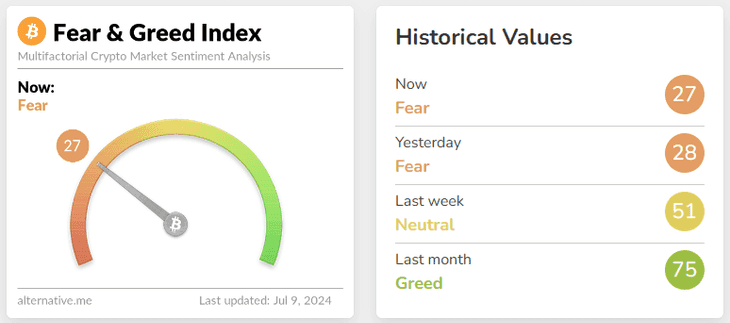

Reading the Crypto Mood Ring "My Precious!":

0-24: Extreme Fear (Investors are hiding under their desks)

25-49: Fear (Investors are cautiously peeking out)

50-74: Greed (Investors are smiling and buying more)

75-100: Extreme Greed (Investors are throwing crypto parties)

How to Use This Magical🪄 Index?

The crypto market behaviour is very emotional and so the Fear and Greed Index can literally save you from your own emotional overreactions and see you benefit from others. Here's how:

Buying and Selling:

Buy During Fear: When the index screams “fear,” prices might be in the bargain bin. Time to shop like it's Black Friday (at Bamboo we call this 'Buying The Dip').

Sell During Greed: When the index shouts “greed,” prices could be sky-high. Might be a good time to cash out and buy yourself something nice. Cher-ching!

Feeling the Market’s Vibe: The index gives you a peek into the collective psyche of crypto investors. Use it to decide if you want to jump in or stay on the sidelines and remember; nothing goes up in a straight line!

An Example, Just for Laughs

Imagine checking the Fear and Greed Index, and it’s at 20 (Extreme Fear). Investors are acting like it’s the end of the crypto world. Prices are down, and it might be a great time to swoop in and grab some deals. On the flip side, if the index is at 80 (Extreme Greed), investors are riding high on euphoria. Prices are up, and it could be the perfect time to cash in and maybe even treat yourself to a new gadget or two.

So, there you have it—the Fear and Greed Index, your quirky guide to the rollercoaster of crypto investing. Just remember, while it’s fun to watch the market’s mood swings, always do your homework and invest wisely.

Happy investing🌱!

*****

Disclaimer

The information provided in the above content is for informational purposes only and should not be construed as financial, investment, or professional advice. The content is based on publicly available information and does not take into account the specific financial situation or objectives of any individual or entity.

Readers are advised to conduct their own research and consult with qualified financial professionals before making any investment decisions. The author and the platform do not endorse any specific products, services, or strategies mentioned in the content. Any reliance on the information provided is at the reader's own risk.

The content may be subject to change, and the author and the platform make no representation or warranty of any kind, express or implied, regarding the accuracy, completeness, or suitability of the information provided.

The author and the platform disclaim any liability for any direct, indirect, incidental, special, or consequential damages arising out of or in any way connected with the use or reliance on the information provided in this content.

Crypto Jargon – The Phrases You Hear but Don’t Understand Explained!

How to Find Reliable Crypto Information

5 companies that changed their mind about Bitcoin.

The latest crypto news delivered straight to your inbox.

Subscribe to our newsletter