Active vs Passive Investing: What's the Difference

Active vs Passive Investing: What's the Difference

To make your money work for you, it can’t just be left in a savings account. Investing is a great way to build wealth in the long term, whether it be in a retirement account, a portfolio of stocks, or a self-managed fund.

There are two types of investing: active vs passive investing. As the name suggests, active investing involves actively buying and selling assets based on market conditions. Passive investing is a less exciting, long-term strategy of leaving your investment to mature over a long period.

In this article, we explore the difference between active and passive investing and weigh up the advantages and disadvantages of each strategy.

Active vs Passive Investing

The main difference between passive investing vs active investing comes down to risk and returns: active investing is riskier but has the potential to deliver larger returns, while passive investing is low-risk and therefore likely to deliver lower returns.

For example, with active investing, you can lose a lot of money on a badly timed trade, whereas, with passive investing, your money remains relatively safe in an index fund like the S&P 500 or similar. An index fund is a portfolio of well-performing stocks providing broad market exposure and limiting the potential for large losses. They are commonly included in retirement accounts like an IRA or 401(k).

Let's explore active and passive investment strategies in more detail.

What is Active Investing?

Active investments funds are traditionally run by a portfolio manager who works for an asset management firm or hedge fund. Their job is to try to outperform a chosen benchmark, typically index funds like the S&P 500, by accurately predicting how prices will move.

A portfolio manager will invest your capital into active mutual funds or exchange-traded funds (ETFs) that provide a ready-made portfolio of hundreds of stocks and assets. Using a broad spectrum of quantitative and qualitative data combined with global economic trends and market sentiment, fund management companies can make informed decisions about which assets to buy and sell.

Costs and Benefits of Active Investing

A portfolio manager should have a good understanding of markets and work daily to find stocks that they believe will go up in value. They will then buy these stocks for you at a good price with the aim to sell them later for a profit. In addition to just buying and selling, fund managers have access to advanced trading tools like short sales and put options, which give them an extra edge over the market. Of course, if your portfolio manager makes a mistake, it's your money that's lost, not theirs.

The costs involved in active investing are higher than passive investing because more trades are being made, each of which attracts a percentage fee. However, if your portfolio manager knows how to time the market well, they could net you gains that far surpass the cost of fees. Portfolio managers can also provide you with a tailored tax management strategy that helps to keep your capital gains tax payments to a minimum.

Self-managed Active Investment

The recent popularity of financial trading apps like Robinhood has given rise to a new breed of investors who choose to run their own active investment portfolio. While this method of 'day trading' could save you money on fees, it's hard to succeed unless you have a very good understanding of the market. A CNBC report found that as little as 3% of day traders make a profit.

With a self-managed active investment strategy, you will also need to keep detailed records of all your trades so you can do your capital gains tax return at year-end. However, depending on your investment structure you may be able to use any losses that you make to offset capital gains tax payments on your gains.

Advantages of Active Investing

- Could potentially outperform passive investments

- Minimize tax payments via tailored management strategy

- Access to advanced trading tools

Disadvantages of Active Investing

- Prone to human error

- More expensive than passive investing

- Riskier than passive investing

- Prompt several capital gains tax events

What is Passive Investing?

There is no more true saying than: "Time is money", and when it comes to passive investing, it rings truer than ever. The longer you have money invested, the greater the likelihood of positive returns, but this doesn't mean you have to dedicate a lot of time to managing your investments. Passive investing is an entirely hands-off activity, so you can sit back and relax while your money works for you.

Passive investors typically choose to invest in an index fund or ETF which involves a highly diversified selection of stocks, bonds, or other assets. The idea is that most of the assets in the fund will perform well enough to offset any losses from assets that underperform. This way, you needn't have to try and guess if specific asset prices will go up or down. In fact, you don't even have to know what assets are included in the fund.

As Ken Fisher of Fisher Investments famously said, "Time in the market beats timing the market"

Some of the most common passive investment options are:

- S&P 500

- Russell 2000

- Dow Jones Industrial Average

- Invesco QQQ Trust

- Nasdaq 100

Passive Investing Options

With passive investing, there are a few different ways in which you can put your money into the market:

- invest a single lump sum at the start and leave it to grow

- make sporadic lump-sum investments whenever you have spare money

- make consistent, periodic investments in what's known as dollar-cost averaging (DCA).

While each of these methods differs slightly, they are similar in that they are long-term investments that don't try to time the market.

Lump Sum

Many passive investors will invest a lump sum of money into an index fund at the start of their investment journey. This may be because they've saved up specifically to invest or they've come into a large sum of money from an inheritance or otherwise.

This is a good way to start investing, especially if you choose a well-trusted, reliable fund with a proven history of gains. However, combining this method with DCA investing (by adding funds over a period of time) may reduce your market timing risk.

Sporadic Investments

Another form of passive investing is to invest random sums of money as and when you can afford it. This is similar to DCA investing but lacks automation and could falter unless the investor is committed. To ensure you stick to your investment strategy, you could implement an automated, monthly investment schedule like DCA.

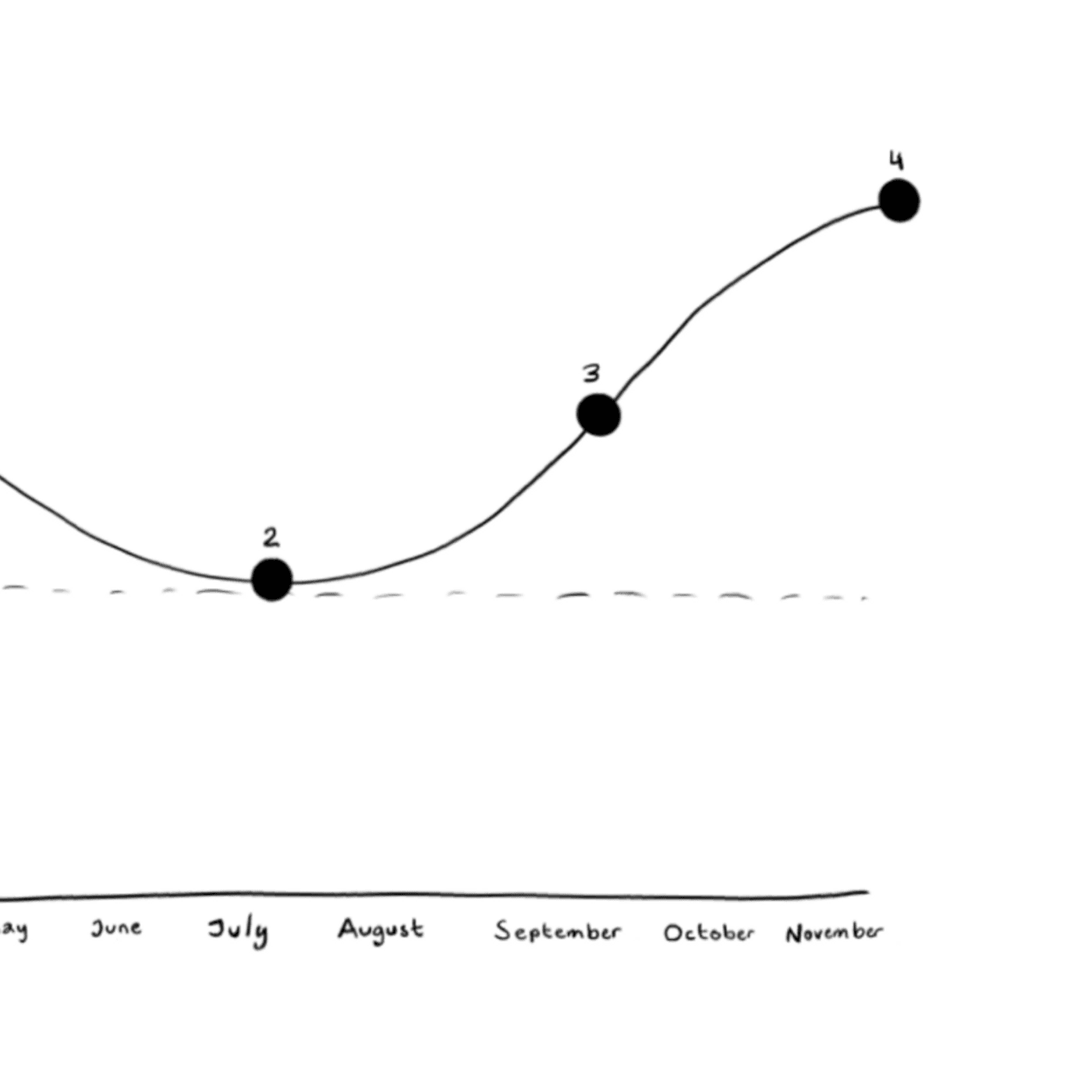

DCA Investing

DCA investing can reduce your market timing risk, and may perform better than active investing as it is spread out over many time periods. With the DCA method, you invest a set amount into a fund on a scheduled timeline, for example, 5% of your paycheck into an index fund each month. The investments are usually debited to your bank account automatically, with no concern for whether the market is up or down. Some months you may end up buying at a high price, and others at a low price, but over time, it averages out.

Statistics reveal that passive investors make more money in the long run than active investors, especially when using the DCA method.

Advantages of Passive Investing

- Minimal risk

- Low cost

- Minimal tax implications

Disadvantages of Passive Investing

- Predictable returns with no chance of making big gains

- Access to a limited selection of assets

In Conclusion

There are clear advantages and disadvantages when it comes to active vs passive investing. Depending on your income, age, position in life, and several other factors, one or the other may appeal to you more. If you already have a solid retirement fund in place and don’t need any further savings, a bit of active investing could be fun. However, if you need to save for your future and can’t afford to lose money, passive investing may be a more reliable, low risk option.

The information provided in this article is for informational purposes only and should not be construed as financial advice. The information provided should not be relied upon for financial decisions. The author is not a financial advisor and is not qualified to provide financial advice.

The author does not endorse any of the products or services mentioned in this article and is not responsible for any losses or damages that may occur as a result of using the information provided in this article.

It is important to do your own research (DYOR) and understand the risks involved before investing in any cryptocurrency or other financial product. You should also consult with a financial advisor before making any investment decisions. Investing in cryptocurrencies is a high-risk investment. You should only invest money that you can afford to lose.

Why Craig continues to buy regardless of the market

Dollar-Cost Averaging 101

The latest crypto news delivered straight to your inbox.

Subscribe to our newsletter