How Micro-investing May Turn into Major Profits

How Micro-investing May Turn into Major Profits

The number one concern that people have when asked about investing is whether they can afford it. The biggest misconception about investing is that you need a lot of capital to get started… wrong! Nowadays, anybody with a mobile phone can instantly start investing in profitable assets with literally just their spare change.

The Bamboo app allows you to round up every purchase you make to the nearest dollar and automatically invest the remaining few cents into digital assets. It’s quick and easy to get started and once set up, you can just forget about it and let the profits grow. The tiny investments are barely noticeable but add up to a sizeable amount over time, building your savings and giving you exposure to investing while you go about your day.

When you realise the best way to invest is consistently and with your spare change 😎 🍹 #effortless #investing pic.twitter.com/IM6PLUGZVV

— Bamboo (@getbambooapp) February 10, 2021

Using modern banking technology, Bamboo securely connects to your existing bank account, automatically calculates the change, and transfers the money into assets. For example, if your weekly grocery shopping comes to $49.20, Bamboo rounds it up to $50.00 and automatically invests the remaining 80c for you.

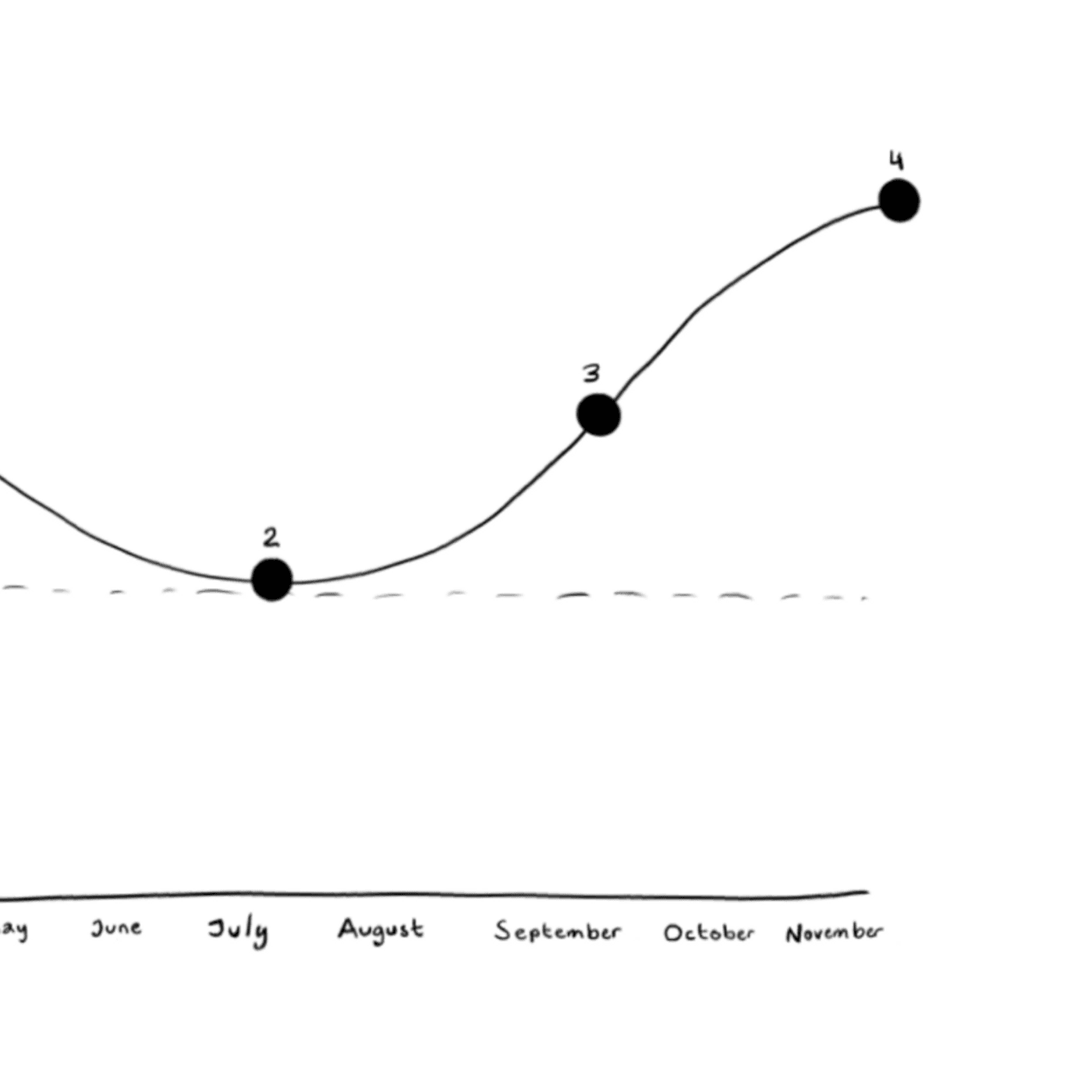

12 Months of interest from the bank vs 6 months of Bamboo 📱👍 pic.twitter.com/NGLWGRNneN

— Jake (@Jake17970845) January 20, 2021

To a large degree, the strategy reduces risk because it involves tiny amounts of money that would otherwise go unnoticed. In the old days, people would collect their left over coins in a jar to gather dust and never get used. Not only that — all traditional currencies depreciate over time, meaning they lose value. Digital assets like Bitcoin are hard-coded with increasing scarcity to ensure that they appreciate, or gain value, over time.

If you feel uncertain about investing in cryptocurrencies, Bamboo also provides the option to invest in traditional assets like Gold and Silver. As two of the world’s most sought-after precious metals, Gold and Silver are highly reliable and stable investments with centuries of trust behind them. During economic recessions, when other markets are struggling, investors often turn to gold as a safe-haven against financial losses.

You can also configure your Bamboo account to diversify your investments across its full range of assets, including Gold, Silver, Bitcoin and Ethereum. This way, you stand to benefit from both the reliability of precious metals and the volatility of cryptocurrencies.

Over the past five decades, gold’s average return on investment (ROI) has been 10.44%. Bitcoin has produced a mean annual return of 408.8% over the past 10 years but it’s ROI fluctuates heavily, going from -72.6% in 2018 to 302.8% in 2020. This highlights the importance of diversifying your investments.

Available on both iOS and Android, the Bamboo app only takes minutes to install and link to your bank account. Once done, you can sit back and relax while your micro investment strategy takes care of itself.

Disclaimer

Past performance may not be indicative of future results. Therefore, you should not assume that the future performance of any specific cryptocurrency will be profitable or equal to corresponding past performance levels. Each investing decision you make should be determined with reference to the specific information available and not based on past performance.

The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.

Active vs Passive Investing: What's the Difference

Why Craig continues to buy regardless of the market

Dollar-Cost Averaging 101

The latest crypto news delivered straight to your inbox.

Subscribe to our newsletter