The Art of Dollar Cost Averaging

The Art of Dollar Cost Averaging

Time in the Market > Timing the Market

If you ask the average Joe what they think the most successful investors do, they’d more than likely tell you they know how to time the market, or put more simply - buy the bottom and sell the top. And while that may be true for a unique few, another common strategy adopted by many investors is called Dollar Cost Averaging or DCA for short.

DCA essentially means you average your overall position, by consistently investing at scheduled and regular intervals regardless of the current price and market movements over a long period of time. While this might mean you occasionally buy at a high price and sometimes at a low price - by averaging in your position it eventually evens out. Spreading the investments across a whole host of market conditions, will also spread your risk over time.

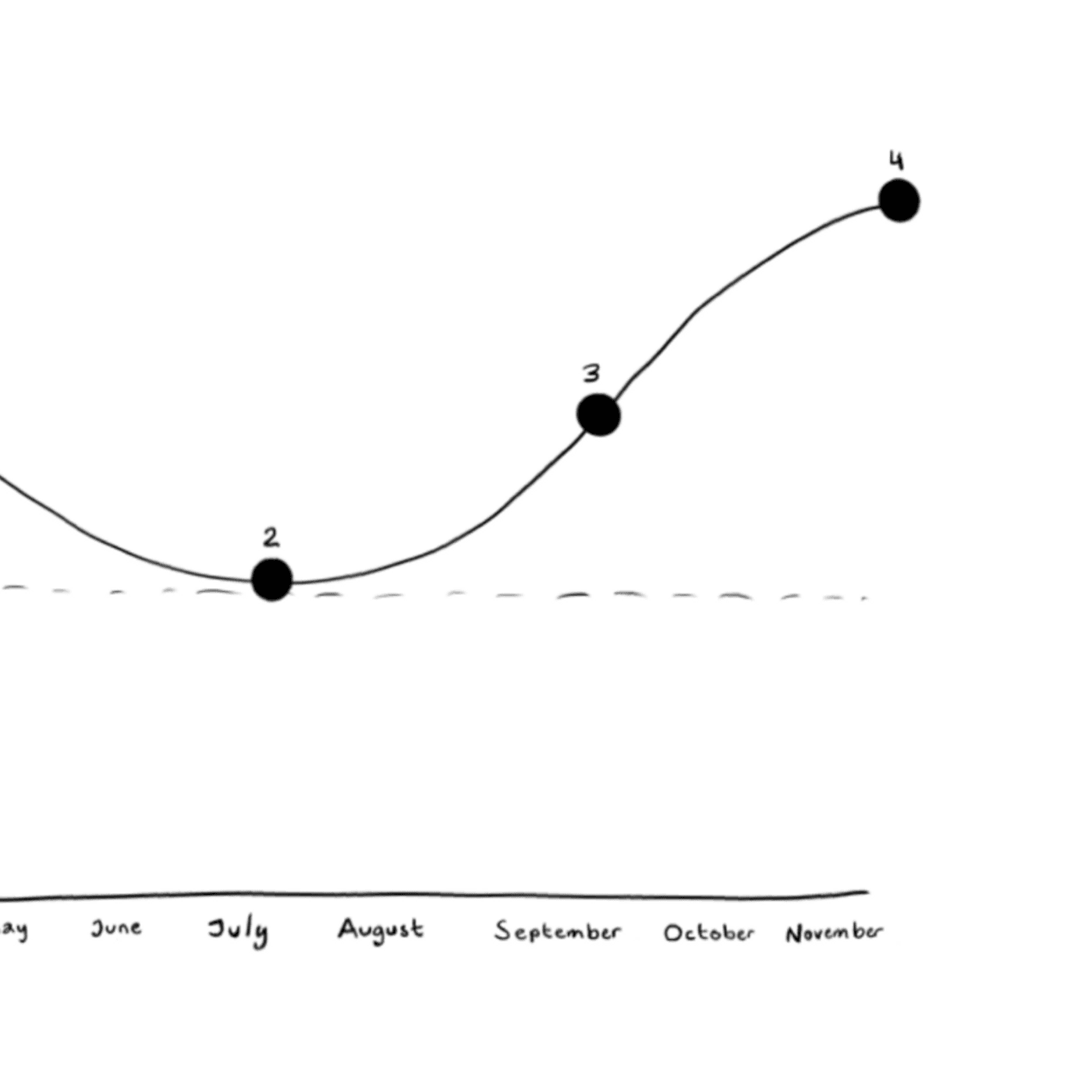

As an example let's say, you have decided you’ll DCA every couple of months, with $10 each time and when you start investing in March the asset's value is $10 dollars per unit. So your first investment gets you one unit.

Over the course of the next few months the price of the asset falls significantly, down 20% to $8 dollars per unit by the time you invest again in July. As the asset price in July is $8 per unit, your $10 can get you 1.2 units of the asset for your $10 investment.

Then let’s say by the time September rolls around the asset's value has recovered to $9 dollars per unit. You invest another $10, meaning you’ve accumulated another 1.1 units of the asset.

You have another scheduled investment in November and by that time the value of the asset is again back to $10 dollars per unit. If you had just made a one-off investment in March, then your portfolio value would remain the same, with zero growth.. However, because you had adopted the DCA investing strategy(ie: consistently invested regardless of the price volatility) and therefore continued to invest in the assets even when the price had fallen to $8 and $9 in July and September respectively, your portfolio value has now increased by 10% in overall thanks to averaging in your position.

See the diagram below for a visual representation of this philosophy.

In summary, when the market is down it means that your purchasing power or investment capacity increases - thanks to the assets becoming cheaper assuming your investment amount remains the same. As a result, and as seen in the example above - the dips in the market can actually provide a great opportunity to increase portfolio value in the long term and therefore be one of the most important times to continue to invest.

The information provided in this article is for informational purposes only and should not be construed as financial advice. The information provided should not be relied upon for financial decisions. The author is not a financial advisor and is not qualified to provide financial advice.

The author does not endorse any of the products or services mentioned in this article and is not responsible for any losses or damages that may occur as a result of using the information provided in this article.

It is important to do your own research (DYOR) and understand the risks involved before investing in any cryptocurrency or other financial product. You should also consult with a financial advisor before making any investment decisions. Investing in cryptocurrencies is a high-risk investment. You should only invest money that you can afford to lose.

Active vs Passive Investing: What's the Difference

Why Craig continues to buy regardless of the market

Dollar-Cost Averaging 101

The latest crypto news delivered straight to your inbox.

Subscribe to our newsletter