What is 'rule of 72' and how do you use it?

What is 'rule of 72' and how do you use it?

Investors, those interested in personal finance or even those nearing retirement want to know the answer to the “how long” questions when setting their financial goals. The famous rule of 72 is a popular and simple formula giving a rough estimate of the time period in years it will take for an investment to double in value from an initial investment at a compounding rate of return.

There are online calculators or complex spreadsheets that provide accurate results on the actual number of years required for an investments doubling time, but the rule of 72 is like a “rule of thumb”.

What does the rule of 72 show you?

This simple calculation will allow you to quickly figure out how many years it will take to double the invested money at a compounded interest rate, or to calculate the annual interest rate needed to double the initial investment within a given amount of years.

The rule of 72 is great for beginner and veteran investors alike as it's very easy to remember, oftentimes doesn’t require a calculator, and is a pretty accurate result for a rough calculation. There are other rules and equations, like the rule of 69.3, the rule of 70, and the rule of 73 which will be explained also.

The formula for the rule of 72

There are two ways to use the rule of 72, one to calculate the years for the investment to double and one to calculate the annual rate of return, both are a basic formula:

72 / average rate of return = How many years to double

The calculation for how many years for the investment to double in value is to divide 72 by the given rate, this assumes that there is a fixed annual rate over the time period of the investment.

72 / how many years to double = Average rate of return

The calculation for the interest rate needed for the money to double with a certain number of years is to divide 72 by the amount of years.

Using the rule of 72

Below will be a quick explanation on how to use each iteration of the rule of 72:

Mark has an account with a present value of $5,000, he’s investing it over the next eight years and wants this initial value to grow to the future value of $10,000.

To figure out what rate he needs so he can use compounding interest to grow his account, Mark will:

- Take the number 72

- Divide it by eight (the number of years)

The result is 9, so Mark will need to look around for some financial products offering a 9% annual rate.

Let’s do a calculation for another exampleHeather has found some financial products offering a great compound interest rate of 10%, she has a current balance of $2,000 and wants to know her investment accounts doubling time.

To figure this out

- She takes the number 72

- Divides it by 10 (the given rate of 10%)

The result is the estimate number of years it will take for the value of the initial investment to double, in Heather’s case it’s about seven years.

Note you have to divide the annual percentage rate by the number stated, don’t convert the percentage into a decimal like you might in other calculations. In the example above, converting 10% to a decimal would be 0.1 in which case it’d take 720 years for the money to double!

Other ways to use the rule of 72

The rule of 72 is not for simple interest calculations, it is however a calculator for anything that experiences exponential growth at a compounded rate, such as inflation, gross domestic product (GDP), even the effect of fees on something like a savings account.

Looking at fees, these can definitely eat away at your investments, say you're investing in some mutual funds with a 2% annual expense fee, those fees will reduce the principal amount to half its value in 36 years. Someone who pays a 9% interest rate on a credit card or loan will double their owning amount in eight years.

In terms of inflation, the rule of 72 can be used to determine how long it will take for money to lose half its value, say the inflation rate is 4%, then it will take 18 years to lose half to inflation (72 / 4 = 12). If inflation rises to 6%, it would take approximately 12 years and so on.

The inflation calculation is essential for retirement planning, so you can feel confident that any accumulated interest will cover you, if not, look around for a higher interest rate, it doesn’t hurt to have more money for your golden years!

How accurate is the rule of 72?

As mentioned, the rule of 72 is a rough estimate, it is more accurate if something is at a fixed rate of course, but in the end it’s actually a simplified version of a complex logarithmic equation.

If you want to know the exact time it will take to double your money or any of the other use this formula:

t = ln(2) / ln (1 + r / 100)

t = number of periods

r = interest rate per period

What about the other rules? What do they do?

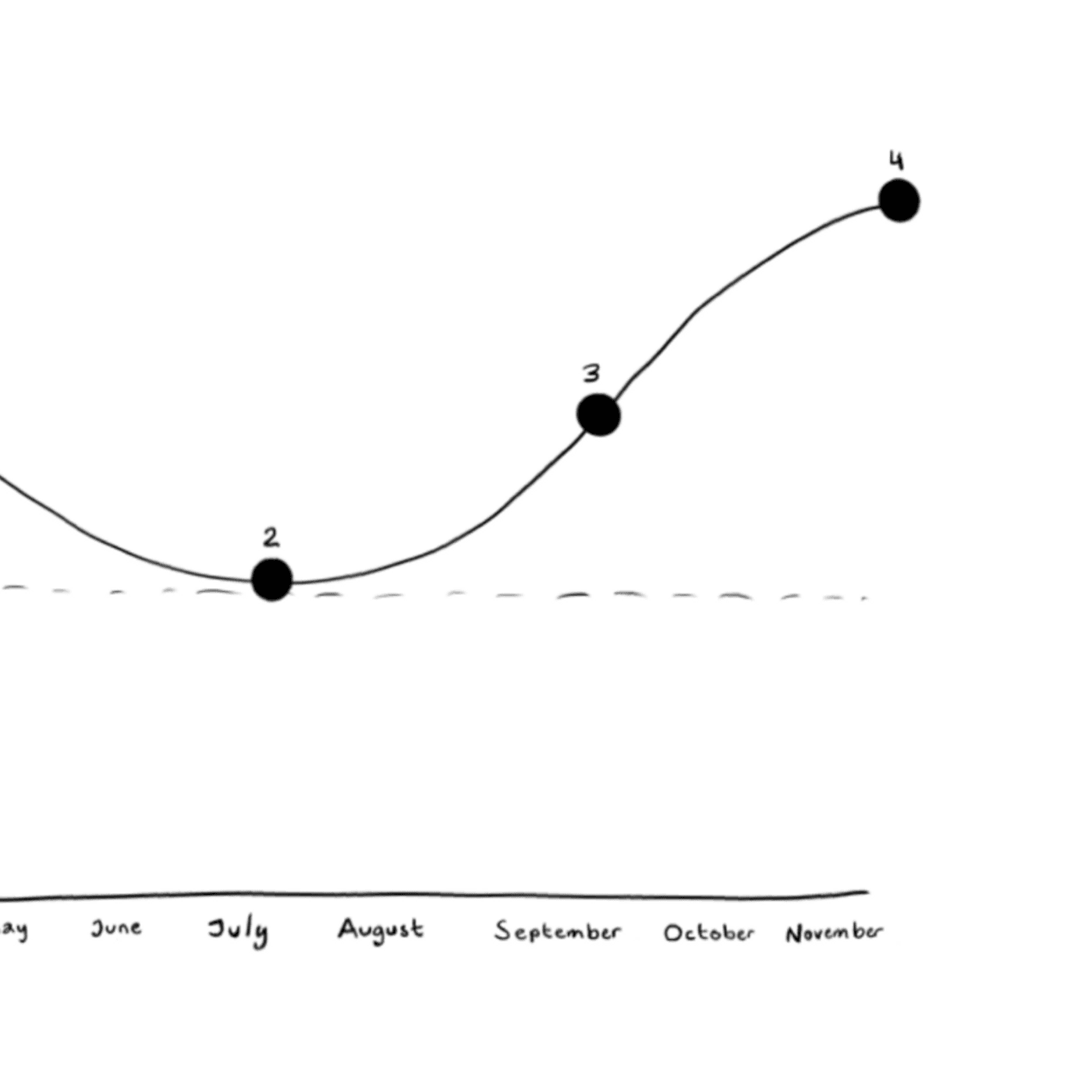

The rule of 72 is most accurate for interest rates that are between 6% to 10%, for higher rates a larger number to replace 72 will provide more accuracy and conversely a lower number for lower rates.

The rule can be adjusted by adding 1 to 72 for every three points the interest rate diverges above 8%, and subtracting 1 for every three points of divergence below 8%, it’s still the same formula with only one slight change.

For example, if the specified rate is 12%, the rule of 72 would apply as it’s 4 points above 8, if the interest rate was 17% it would be the rule of 75 and so on.

The rule of 71 is for the inverse, so a lower interest rate of 5% can use this rule as 5% is 3 points below 8% and 4% would use the rule of 70 as its 4 points below.

There is also the rule of 69.3 which works best for daily compounding interest, although some choose to just use the rule of 70 for this instead as it’s close enough.

So there you are, armed with your new knowledge, you’re ready to forge ahead and use these rules to calculate the future value of your investments! Keep in mind, past performance does not indicate future performance, so invest wisely.

Active vs Passive Investing: What's the Difference

Why Craig continues to buy regardless of the market

Dollar-Cost Averaging 101

The latest crypto news delivered straight to your inbox.

Subscribe to our newsletter